At NIF4Erasmus, we understand that navigating the Erasmus experience can raise many questions, especially when it comes to managing your NIF and understanding the tax system abroad.

In this section, we've gathered answers to the most common questions from students just like you, if you can't find what you're looking for, feel free to reach out to us for further assistance!

The NIF (Número de Identificação Fiscal) is your taxpayer identification number in Portugal. It’s essential for many everyday tasks, like signing a rental contract, opening a bank account, getting a mobile phone plan, or signing up for health insurance. You may also hear it called the "Número de Contribuinte".

Yes, you can request your NIF from anywhere in the world.

Usually, the process of obtaining your NIF takes between 3 to 5 business days. This duration is subject to variation based on certain factors, primarily hinging on the operational efficiency of the Portuguese Tax Office.

We support all nationalities for our NIF service.

You just need 2 documents to request your NIF:

Additional requirements apply for minors.

If you are applying for a NIF for a minor under the age of 18, you need to submit the following additional requirements:

A proof of address is a document used to verify a person's residential address for their NIF application. You can submit one of the following documents, provided it meets the conditions below:

Name and surname on your proof of address: Your first name and surname on your Proof of Address must match your passport/National ID card exactly.

Language of the document: If the document is not written in the Roman alphabet, you need to provide an English translation.

Minor: If you are requesting a NIF for a minor (child under 18), please include the proof of address of one of the parents.

If you are a citizen of the European Union (EU), the European Economic Area (EEA), or Switzerland you can register your NIF with a Portuguese address by providing a CRUE (Certificate of Registration of an EU Citizen - Certificado de Registo de Cidadão da União Europeia).

This certificate proves that you are legally residing in Portugal as an EU citizen and allows your NIF to be officially linked to a Portuguese address. Registering your NIF with a Portuguese address is important if you want to be recognized as a tax resident in Portugal.

Only EU citizens are eligible to use the CRUE for this purpose.

A CRUE (Certificate of Registration of an EU Citizen - Certificado de Registo de Cidadão da União Europeia) is an official document that confirms your legal residence in Portugal. It is required to register your NIF with a Portuguese address and to be recognized as a tax resident in Portugal.

You can obtain a CRUE at the local city hall (Câmara Municipal) in the municipality where you live in Portugal. Some municipalities may require an appointment, so it’s recommended to check their website or contact them directly before visiting.

If you are a citizen of a country outside the European Union, the European Economic Area (EEA), or Switzerland, you cannot use a CRUE. Instead, you must provide one of the following documents issued by AIMA (Agência para a Integração, Migrações e Asilo):

These documents serve to prove your legal connection to Portugal and allow your NIF to be linked to a Portuguese address. Providing the correct documentation is essential for your NIF to reflect Portuguese tax residency, which may be important for financial, legal, and tax purposes.

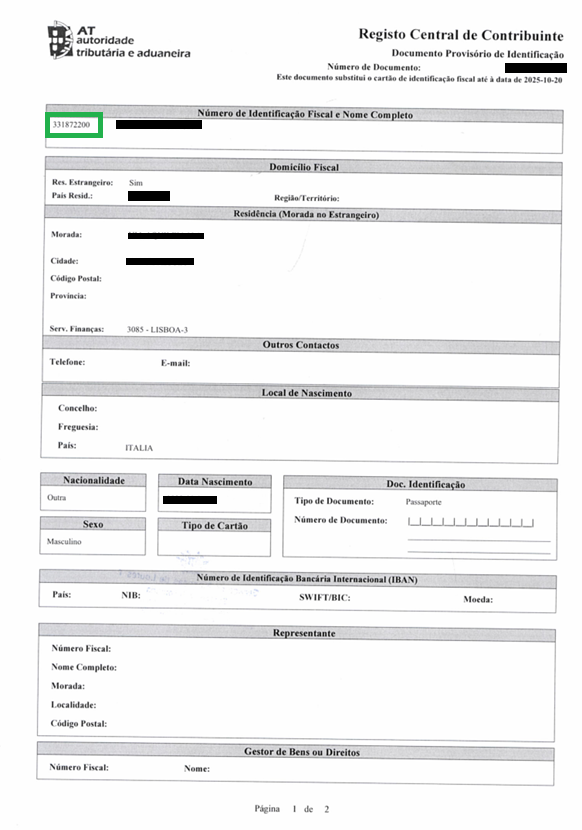

You can find your NIF in the upper left corner of the PDF document provided by Finanças.

No, NIF doesn’t have an expiry date, it is issued to you for life.

With your password you will be able to access the Portuguese tax office website, also known as Portal das Finanças, and through the portal, you can submit tax returns, issue and review electronic invoices, make payments, obtain certificates, update personal and business information, check fiscal status, and more, so you can manage your tax matters quickly and securely online.

The password request service is included only for clients who purchase TAX REPRESENTATION service. For all other services, a password can be requested for an additional fee of €10 per request through NIF4Erasmus.

Your password will be delivered to your address (EU/EEA Citizen, Norway, Iceland, and Liechtenstein, as well as citizens of Andorra and Switzerland) or fiscal representative (Non EU/EEA Citizen) by physical mail and usually takes about 3 - 4 weeks.

Yes! An electronic signature is accepted provided that it matches the signature on your passport/national ID card exactly.

No, you do not need to notarize the Power of Attorney document. You simply need to make sure that your signature on the Power of Attorney document matches the one on your passport exactly.

The NIF is issued by the Portuguese Tax and Customs Authority (Autoridade Tributária e Aduaneira), commonly referred to as Finanças.

The NIF (Número de Identificação Fiscal) is just a number, not a physical card. In Portugal, the physical NIF card no longer exists. Once your NIF is issued, you will receive it in digital format.

Yes, you need a NIF to rent a house in Portugal.

Rental contracts must be officially registered on the Portuguese Tax Authority’s platform (Portal das Finanças), and for that, all parties involved - including the tenant - must have a valid NIF. It’s highly recommended to obtain your NIF before searching for accommodation, as most landlords will ask for it upfront.

Yes. A NIF is mandatory to open a bank account in Portugal. Banks will require it as part of your identification and tax registration process.

Yes, you can. There is no minimum stay required to obtain a NIF. Even if you’re staying in Portugal for just a few months, having a NIF is often necessary for basic tasks like signing a lease or getting a phone plan.

The tax representation is a legal service that allows non-residents in Portugal to have a representative in the country for tax purposes. This representative will handle all tax-related matters, such as filing taxes and communicating with the Portuguese tax authorities on your behalf.

Getting a tax representative in Portugal is a requirement for non-EU/EEA Citizen, in order to obtain a Portuguese NIF.

No, there is no difference between a tax representative and a fiscal representative, both terms refer to the same role in Portugal.

One of the lawyers from NIF4Erasmus will be your tax representative in Portugal, managing all the necessary paperwork and communication with the Portuguese tax authorities on your behalf.

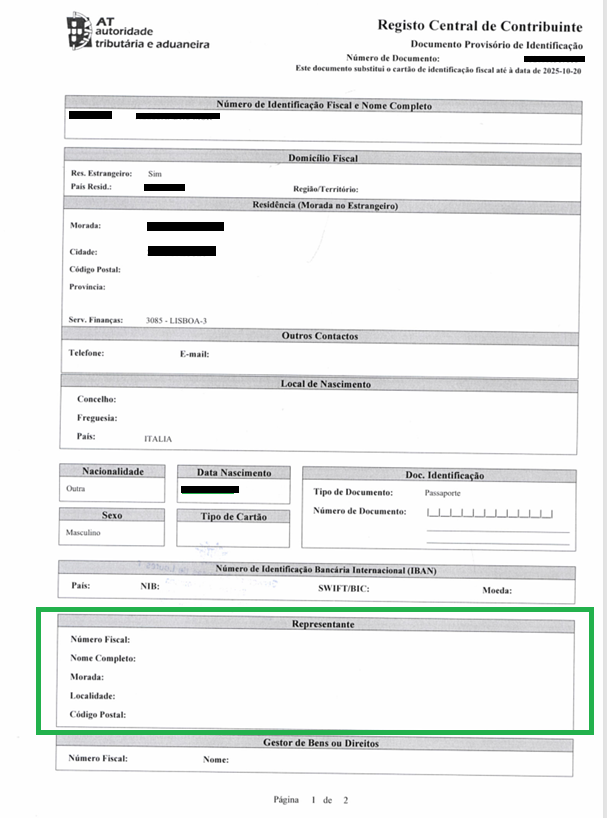

You can find that information at the bottom of the document.

Yes, you can change your fiscal representative. If you wish to switch to a different representative, you will need to inform NIF4Erasmus.

Yes, NIF4Erasmus offers ongoing fiscal representation for non-residents. This service is available annually (100€/year), ensuring that your tax-related matters are always handled efficiently.

To cancel your fiscal representation with NIF4Erasmus, you will need to contact us by message or email. We will guide you through the cancellation process and ensure that all necessary steps are taken to terminate your representation.

Yes, if you are a non-resident in Portugal and fail to have a tax representative when required, you could face penalties or fines. Having a tax representative ensures compliance with Portuguese tax laws.

Yes, we will notify you in advance before your fiscal representation expires, so you can renew the service and continue your tax representation without any interruptions.

After NIF4Erasmus receives your NIF, we will request your password from the Portuguese tax office. Your password will be delivered to your address (EU/EEA Citizen, Norway, Iceland, and Liechtenstein, as well as citizens of Andorra and Switzerland) or fiscal representative (Non EU/EEA Citizen) by physical mail and usually takes about 3 - 4 weeks.

If we are your tax representative, once your password has been received, we will send you a copy via email. You will now be able to access the Portuguese tax office website, also known as Portal das Finanças.

If you have a permanent Portuguese address and are considered a resident for tax purposes, you may not need fiscal representation. However, if you are still classified as a non-resident for tax purposes, fiscal representation may still be necessary

If you are a citizen of a country outside the European Union, the European Economic Area (EEA), or Switzerland, you cannot use a CRUE. Instead, you must provide one of the following documents issued by AIMA (Agência para a Integração, Migrações e Asilo):

These documents serve to prove your legal connection to Portugal and allow your NIF to be linked to a Portuguese address. Providing the correct documentation is essential for your NIF to reflect Portuguese tax residency, which may be important for financial, legal, and tax purposes.

The process is straightforward: first, you fill out the form, submit the required documents, and make the payment. After that, we will review the documentation. If there is anything that is not in compliance, we will ask you to provide the necessary corrections. Once everything is in order, we will send you the power of attorney for your signature. After receiving the signed power of attorney, we will submit your application to the Portuguese tax authorities (Finanças). We will guide you every step of the way to ensure a smooth experience.

Once you submit your documents, we’ll review them to ensure everything is in order. You will also be required to complete the mandatory identity verification via a trusted KYC provider, and we will send the Power of Attorney for your signature. After the signed Power of Attorney is received, we will submit your application to the Portuguese tax authorities (Finanças). You will receive your NIF directly from us, and we’ll notify you as soon as it’s ready.

As part of our service, we require an identity verification (IDV) using a secure KYC program. This involves confirming your identity through official documents (such as a passport or national ID) and a brief verification step via a trusted verification provider. This process is necessary to comply with legal and regulatory requirements and to ensure the secure provision of our service.

Yes, the service is 100% online. You can submit your documents, communicate with us, and receive your NIF all without needing to visit our office.

Yes, if any issues arise with the Finanças, we are here to help. Our team will assist you in resolving the matter and ensuring that your NIF is issued without problems.

You can request a refund before the service begins, in which case the full amount paid may be refunded. Once the power of attorney has been drafted, refunds are limited to 50% of the amount paid. After the power of attorney is signed, no refund is possible.

Refund requests must be sent by email to info@nif4erasmus.com with the subject “REFUND REQUEST”, including your full name, payment date and time, and amount paid.

For services contracted exclusively through digital means and paid via electronic payment platforms (such as Stripe, among others), NIF4Erasmus reserves the right to refund only the net amount received, excluding any fees or commissions charged by those platforms for processing the payments.

Refunds may also be limited to 50% if the service is already in progress but delayed due to reasons attributable to the client. For more information, please consult our Terms and Conditions.

No, there is no right to any financial compensation. We do not offer financial compensation in any circumstances.

The fee covers the complete processing of your NIF application, including document verification, submission to the tax authorities, and our support throughout the entire process. You will receive your NIF upon completion. The password request on the tax authority portal is included only with the tax representation service.

The cost of the NIF service is €50, if fiscal representation is required the cost will be €100.

This covers all steps in the NIF application process, and customer support until you receive your NIF. The request for your password on the tax authority portal is included only with the fiscal representation service; for other services, it can be requested through NIF4Erasmus for an additional fee of €10.

Yes, absolutely! Although NIF4Erasmus was created with Erasmus students in mind, our service is open to anyone who is interested or needs a Portuguese tax number (NIF). If you´re moving to Portugal and need a NIF, we´re here to help – regardless of your student status.

Yes, we do. Since we are lawyers, we can assist with other legal services you may need. Just get in touch with us and let us know how we can help!

Didn’t find the answer you were looking for? Reach out to us by email or message and we’ll be happy to assist you.